Market Commentary for 01-04 Feb 07

Here are some of the more significant Insider and Substantial Shareholder transactions reported on the SGX over the past week :

C K TANG LTD/ Director/ 1-Feb-07/ Tang Wee Sung/ Kerith Holdings Pte Ltd/ See APPENDIX/ 2078000

CAMBRIDGE INDUSTRIAL TRUST/ Subst Shrhdr/ 1-Feb-07/ Brilliant Manufacturing Limited/ Sales in open market./ -2000000

CHINA FASHION HOLDINGS LIMITED/ Director/ 30-Jan-07/ CHEN XI JIAN/ SALE OF SHARES UNDER A MARRIED DEAL/ -1500000

CSE GLOBAL LTD/ Subst Shrhdr/ 30-Jan-07/ FMR Corp./ Market transaction./ 1391000

FABCHEM CHINA LIMITED/ Director/ 1-Feb-07/ DR LIM SECK YEOW/ Off-market transaction./ -23166000

FABCHEM CHINA LIMITED/ Subst Shrhdr/ 1-Feb-07/ FORTSMITH INVESTMENTS LIMITED/ Off-market transaction./ -46800000

FABCHEM CHINA LIMITED/ Subst Shrhdr/ 1-Feb-07/ DNX AUSTRALIA PTY LIMITED/ Off-market transaction./ 69966000

FIBRECHEM TECHNOLOGIES LIMITED/ Subst Shrhdr/ 1-Feb-07/ Lonsdale Group Limited B.V.I./ Sale of Shares/ -24636000

HOTUNG INVESTMENT HLDGS LTD/ Subst Shrhdr/ 31-Jan-07/ Third Avenue Management LLC/ Open Market Purchase/ 498000

JIUTIAN CHEMICAL GROUP LIMITED/ Subst Shrhdr/ 1-Feb-07/ UOB Asset Management Ltd (UOBAM)/ Open Market Purchase/ 1500000

LIFEBRANDZ LTD./ Director/ 1-Feb-07/ Thomas Carlton Thompson 3rd/ Sales in Open Market at Own Discretion/ -1000000

LIFEBRANDZ LTD./ Director/ 31-Jan-07/ Thomas Carlton Thompson 3rd/ Sales in Open Market at Own Discretion/ -2000000

OLAM INTERNATIONAL LIMITED/ Subst Shrhdr/ 31-Jan-07/ The Capital Group Companies Inc./ Open Market Purchase/ 15946000

PEOPLE'S FOOD HOLDINGS LIMITED/ Subst Shrhdr/ 29-Jan-07/ Templeton International Inc./ Acquisition/Disposal of shares./ 11381000

ROLY INTERNATIONAL HLDGS LTD/ Subst Shrhdr/ 30-Jan-07/ Moon Capital Management LP/ Open Market Purchase/ 2435000

The raw data file (in CSV format) can be downloaded here (deleted after 30 days by server) : http://www.savefile.com/files/467320

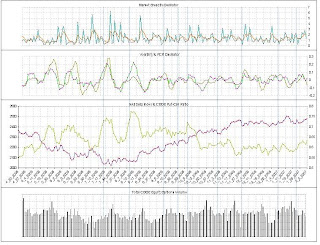

The markets remained bullish, especially the Singapore Bourse. The Nikkei 225 is rangebound at the moment, and has somewhat influenced the Hang Seng to do the same. The support zone for the Nikkei is between 17,200 to 17,300; breaching it would take stochastic indicator to oversold region. There are no extreme readings on the short term market breath indicators to take advantage of as well... an intraday traders' market.

The Purchasing Manager's Index has fallen below the 50% level again in January 2007; last time it happened was in November 2006. From the chart below, it is apparant that the leading characteristic of the Nasdaq index over the PMI (or the economy on a wider view) is slowly decreasing. With 1995 as an exception, the market has pulled back when ever the PMI slowed down.

C K TANG LTD/ Director/ 1-Feb-07/ Tang Wee Sung/ Kerith Holdings Pte Ltd/ See APPENDIX/ 2078000

CAMBRIDGE INDUSTRIAL TRUST/ Subst Shrhdr/ 1-Feb-07/ Brilliant Manufacturing Limited/ Sales in open market./ -2000000

CHINA FASHION HOLDINGS LIMITED/ Director/ 30-Jan-07/ CHEN XI JIAN/ SALE OF SHARES UNDER A MARRIED DEAL/ -1500000

CSE GLOBAL LTD/ Subst Shrhdr/ 30-Jan-07/ FMR Corp./ Market transaction./ 1391000

FABCHEM CHINA LIMITED/ Director/ 1-Feb-07/ DR LIM SECK YEOW/ Off-market transaction./ -23166000

FABCHEM CHINA LIMITED/ Subst Shrhdr/ 1-Feb-07/ FORTSMITH INVESTMENTS LIMITED/ Off-market transaction./ -46800000

FABCHEM CHINA LIMITED/ Subst Shrhdr/ 1-Feb-07/ DNX AUSTRALIA PTY LIMITED/ Off-market transaction./ 69966000

FIBRECHEM TECHNOLOGIES LIMITED/ Subst Shrhdr/ 1-Feb-07/ Lonsdale Group Limited B.V.I./ Sale of Shares/ -24636000

HOTUNG INVESTMENT HLDGS LTD/ Subst Shrhdr/ 31-Jan-07/ Third Avenue Management LLC/ Open Market Purchase/ 498000

JIUTIAN CHEMICAL GROUP LIMITED/ Subst Shrhdr/ 1-Feb-07/ UOB Asset Management Ltd (UOBAM)/ Open Market Purchase/ 1500000

LIFEBRANDZ LTD./ Director/ 1-Feb-07/ Thomas Carlton Thompson 3rd/ Sales in Open Market at Own Discretion/ -1000000

LIFEBRANDZ LTD./ Director/ 31-Jan-07/ Thomas Carlton Thompson 3rd/ Sales in Open Market at Own Discretion/ -2000000

OLAM INTERNATIONAL LIMITED/ Subst Shrhdr/ 31-Jan-07/ The Capital Group Companies Inc./ Open Market Purchase/ 15946000

PEOPLE'S FOOD HOLDINGS LIMITED/ Subst Shrhdr/ 29-Jan-07/ Templeton International Inc./ Acquisition/Disposal of shares./ 11381000

ROLY INTERNATIONAL HLDGS LTD/ Subst Shrhdr/ 30-Jan-07/ Moon Capital Management LP/ Open Market Purchase/ 2435000

The raw data file (in CSV format) can be downloaded here (deleted after 30 days by server) : http://www.savefile.com/files/467320

The markets remained bullish, especially the Singapore Bourse. The Nikkei 225 is rangebound at the moment, and has somewhat influenced the Hang Seng to do the same. The support zone for the Nikkei is between 17,200 to 17,300; breaching it would take stochastic indicator to oversold region. There are no extreme readings on the short term market breath indicators to take advantage of as well... an intraday traders' market.

The Purchasing Manager's Index has fallen below the 50% level again in January 2007; last time it happened was in November 2006. From the chart below, it is apparant that the leading characteristic of the Nasdaq index over the PMI (or the economy on a wider view) is slowly decreasing. With 1995 as an exception, the market has pulled back when ever the PMI slowed down.

The Consumer Sentiment Index for January 2007 came in at 98%, which is an all-time high. But I wouldnt be too happy because this is usually used as a contrary indicator. But for those who have bought into the market a couple of months back, there'll be no shortage of buyers to offload their holdings to.

My Gann DJI Forcast has diverged (a better word for being inaccurate :) for the past two months. So despite all the economic, fundamental, technical, quantiative or sentiment analyses one can do to produce a forecast, the market has plans of its own, and those who try to fight it..... well, we all know the outcome. The big players are obviously not selling out at the moment.

My Gann DJI Forcast has diverged (a better word for being inaccurate :) for the past two months. So despite all the economic, fundamental, technical, quantiative or sentiment analyses one can do to produce a forecast, the market has plans of its own, and those who try to fight it..... well, we all know the outcome. The big players are obviously not selling out at the moment.

The short-term volatility on the Nasdaq has come down slightly, if it falls again during the week, we would most likely see a short term top. The fast market breadth line has also eased slighly while the index gained a little, showing that only selected stocks advanced last Friday, and there was no strength in the move.

0 Comments:

Post a Comment

<< Home