SGX Insider and Substantial Shareholder transactions for 09 - 13 Apr 07 & Market Commentary

Hi all,

Here are the more significant Insider and Substantial Shareholders transactions reported on the Singapore Stock Exchange in the past week:

ASIA-PACIFIC MARKETS COMMENTARY

-------------------------------------------------------

There are no major economic news from the APAC region in the past week. Taking their cue from the US Market, the Australian, Singapore, Hong Kong and Japanese markets all finished higher for the week.

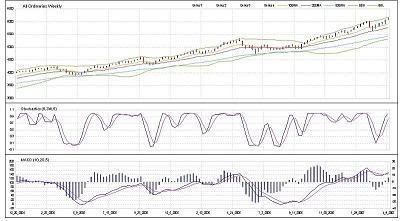

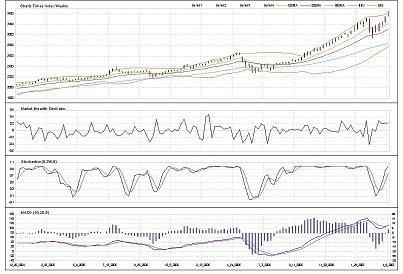

From the charts, the All Ordinaries and Straits Times Indexes did indeed outperform the Nikkei 225 as expected. The flipside being that the All Ords and Straits Times Indexes have both reached overbought levels while the Nikkei finished lower.

A doji appeared on both the charts of the All Ordinaries and Straits Times Indexes with the latter having a more bearish intonation - close enough to be called a Shooting Star Doji in my opinion. Furthermore, the Shooting Star also penetrated the Upper Bollinger Band. The candlestick formation on the Nikkei is also bearish with no other explanation other than that of underperformance in relation to the other indexes.

The Market Breadth Oscillator for the Straits Times Index (This week's new addition) continues to remain in high ground, and if past behaviour is a valid guide, the chances of any substantial rally this coming week is not high.

Overall, although the picture looks bearish from the technical point of view, the markets can still continue to move up at a very gradual pace. Small up candles, yes, large up candles, not likely - unless new fundamental/economic data comes up this coming week.

US MARKET COMMENTARY

--------------------------------------

The only two sets economic data that was released last week that I'm more concerned about are the Producers Price Index and the preliminary Consumer Sentiment Index. The minutes of the FOMC are also important, but I usually leave it to others to read it and let them summarize for me.

The PPI came in above market consensus but below the reading for the prior month while the Core PPI was below both the market consensus and the prior month's reading. Both a sign of weakness.

The same story for the UMich CSI - readings below the consensus and prior month.

Read an interesting article by Bill Gross, PIMCO's lengendary bond man, about the situation of the current housing market in the US. It states that the housing market is about 15-20% overvalued at the moment, and would likely stay below its peak for the next three years or so. As consumer spending weakens, the FED will have to look towards other means of stimulating the economy - and that is to lower interest rates.

For Bill, the lower interest rates would mean a rally for bond prices, but it might not be a done deal for equities. In the recession from 2000 to 2003, rates were lowered at a frantic pace until the recovery in early 2003. So one should keep an eye on inventory levels (i.e. order books), productivity and earnings.

SHORT-TERM OUTLOOK

-----------------------------------

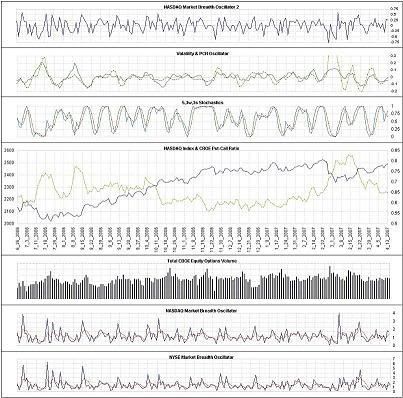

Last week, the analysis was suggesting a short term top in the NASDAQ Composite. The index did pull back for only one day, but decided to go back up. So anyone who went short would've had to cut loss. Goes to show again that there is no holy grail.

On the close of last friday, here's what the short-term indicators are telling us:

(1) NASDAQ Market Breath Oscillator 2 : 0.26

(2) Volatility Oscillator : -0.045

(3) Put-Call Ration Oscillator : 0.0005

(4) Stochastics Oscillator : Fell to 50 and back up

(5) Put-Call Ration EMA : Sideways

(6) CBOE Equity Options Volume : Average

The MBO shot up to high ground and remained there last friday.

The Volatility and PCR Oscillators are not doing much.

The sideways PCR suggests mixed sentiment in the market and the average volume suggests average interest by the participants.

So on an overall basis, the indicators are not providing any strong indication of what might happen in the short run. There is every possibility that it might continue to stay bullish - making the momentum traders very happy but sidelining the swing traders. This alternating between swinging and momentum behaviour by the market is the reason why no one wins all the time. I do believe that there are very capable traders out there who are equally skilful in swing and momentum trading, but majority would usually end up paying school fees trying to second guess what the market's gonna do next.

MEDIUM-TERM OUTLOOK

--------------------------------------

Last week, the MBO sugests a higher possibility of either down or sideways, and it turned out to be wrong. It pull back, but the index closed higher instead.

Here's how the indicators are shaping up:

MBO: Pulled back slightly

Stochastics: Overbought, but still bullish

MACD: %k and %d converged

The pull back on the MBO and a bullish stochastics suggest that the index is likely to finish higher this coming week. I'm watching the 10 and 20 period moving averages closely because a break down through them has bearish implication(s).

I'm not expecting abrupt bull moves in the next few weeks given the high level of the stochastics, the MACD and my monthly indicators - similar to the outlook of the Asia Pacific markets.

Have a gd week!

0 Comments:

Post a Comment

<< Home