SGX Insider and Substantial Shareholder transactions for 14 - 18 May 07 & Market Commentary

Hi all,

I've yet to download the SGX Insider and Substantial Shareholder transactions for the past week and will put them up together with next weeks commentary.

ASIA-PACIFIC MARKETS COMMENTARY

-------------------------------------------------------

DAILY CHARTS:

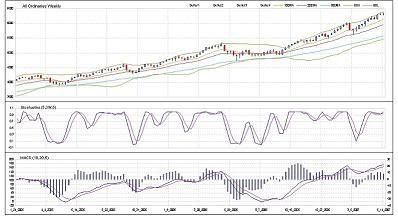

For the past week, the All Ordinaries continues to move within the consolidation range between 6277 and 6377. The ASX market breadth line is again at short term reversal level and may well see the index finish higer this coming Monday (21 May 07). The Stochastics has crossed over to the upside. The immediate resistance is the top of the consolidation range at 6377. I would refer to the weekly chart to get an idea of the possibility of an upside breakout and the continuation of the rally.

The Straits Times Index was also "sort-of" rangebound except that it is somewhat positively inclined. The Market Breadth line is in neutral zone, which usually means that the prevailing trend is likely to continue. The reading on the stochastics is pretty high - something that I'm still trying to accept if I were to go long... I prefer to buy low stochastics readings.

The Nikkei 225 is the underperformer of the lot over these past few weeks. But I like how the indicators look here best. The Market Breadth line is low, and the stochastics is starting to turn over in oversold region. Although there is every possibility that the index can drift lower, the way the other regional indices are looking at the moment don't seem to suggest that happening - unless the All Ordinaries break down from the consolidation zone and the Straits Times index starts heading south. So Monday seems like an up day for the Japanese bourse.

WEEKLY CHARTS:

The the 2-week low of the indices have shifted on the weekly charts:

- All Ordinaries @ 6210 (2 week low not meaningful, using midpoint of 6290-6130 range)

- Nikkei 225 @ 17219

- Straits Times Index @ 3410

It was the Straits Times index's turn to make a new high last week; which is attributed (in my opinion) of the low weekly market breadth reading. The bullish undertone is still there and we may see it make another new high this coming week.

The All Ordinaries continue to look bullish and I've shifted the sell trigger upwards as seen above.

The Nikkei remains rangebound as its weekly stochastics continues to fall. The weekly Bollinger Bands are narrowing to just slightly above twice its average weekly range. The buy trigger for the Nikkei is 12830 - just above the consolidation range.

US MARKET COMMENTARY

--------------------------------------

The CPI for April fell 0.2% from its prior reading whike the Core CPI increased 0.1% of its prior reading. Economic reports showed that consumer spending is supported by low unemployment and the low US dollar. Capacity utilization remains relatively unchanged. The only unexpected data over the past week was the reading on the Conference Board's Leading Indicators Index; it came in significantly lower than prior reading and also lower than market consensus. Some digging needs to be done to determine the trend of the leading indicators to see if it is indeed turning down. If so, the US economy would most likely have well and truly peaked.

SHORT-TERM OUTLOOK

-----------------------------------

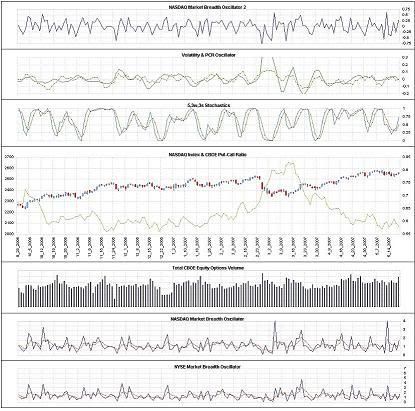

The NASDAQ composite bounced up from last Tuesday's low on low stochastics reading and market breadth levels. But Monday might see the index pause for a day or two before revealing where it wants to go.

On the close of last friday, here's what the short-term indicators are telling us:

(1) NASDAQ Market Breath Oscillator 2

Is now at a relatively high level after recovering from tuesday's low.

(2) Volatility Oscillator

Formed what looks to be a rounding top.

(3) Put-Call Ratio Oscillator

Similar to the Volatility oscillator. Suggesting a short term bottom (back on last tuesday)

(4) Stochastics Oscillator

Moving up

(5) Put-Call Ratio EMA :

Fluctuating at high call buying levels

(6) CBOE Equity Options Volume :

Moderate to heavy - interest in call options.

MEDIUM-TERM OUTLOOK

--------------------------------------

Here's how the indicators are shaping up:

Market Breadth Oscillator: Historically low reading.

Stochastics: Crossed to the downside.

MACD: %k remains above %d

A mixed reading this week, with the market breadth line at low level while the stochastics has made a downside crossover - a bearish suggestion. The bear cross on the stochastics will only be confirmed if the most recent low pivot (2150) is broken. And in the mean time, the coming week has a higher probabilty of finishing higher.

WHAT I'VE BEEN UP TO LATELY

----------------------------------------------------

Worked 45 hours last week... I was really overloaded. Things will probably not get better this coming week as a colleague (a guy from Ireland on a temp contract) just left on Friday to go to Melbourne - as part of his Australian tour - for a couple of months and find temp work while he's there. I guess that's the main difference between the young people in Singapore/Malaysia and the other countries. Young people from Korea, Japan, and all the other western countries leave their country in their early 20s to go travelling. Many of the Asians work as waiters/waitresses and shop assistants. I've yet to see them working as temps in the finance sector...probably that's because the temp roles are all taken by bachelor and master degree holders.... heheh. But with that said, working temp in Australia is better than working temp in Singapore, Malaysia, Indonesia.... etc... hands down.

Have a gd week!

0 Comments:

Post a Comment

<< Home