SGX Insider and Substantial Shareholder transactions for 16 - 20 Apr 07 & Market Commentary

Hi all,

Here are the more significant Insider and Substantial Shareholders transactions reported on the Singapore Stock Exchange in the past week:

ASIA-PACIFIC MARKETS COMMENTARY

-------------------------------------------------------

China makes the headlines once again in the last week, with the fear that the Chinese Authorities would raise interest rates in China because of an overheating economy. The funny thing is that the press did not bother to dig a little deeper to present its readers with supporting evidence(s) in terms of facts and figures. All we've been shown are the CPI numbers. Who's to say that a Y-O-Y reading of 3% on the CPI means that inflation in China is getting out of hand? This magic number applies to the US, but does it apply to China? Maybe there are economic reports out there supporting the magic number, but I've yet to come across it. And I believe that it will quite certainly be worth one's while to dig deeper as the China market still has much untapped potential.

Now it seems like the other Asian Pacific markets have a new influencing variable besides the U.S. market.

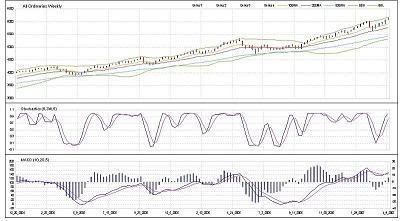

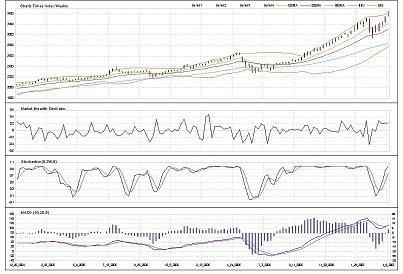

From the charts, the All Ordinaries performed the strongest compared to the Straits Times and Nikkei 225 Indexes.

Long shadow dojis appeared on both the Straits Times Index and the Nikkei 225 suggesting uncertainty in both markets while there's no bearish indication on the All Ordinaries except for the overbought stochastics.

The Market Breadth Oscillator for the Straits Times Index has declined slightly from last week's high reading. So last week's call for either a down or sideways move was on the money.

Overall, the picture from the technical point of view remains unchanged - bearish, with the market still able to continue to move up at a very gradual pace. Small up candles, yes, large up candles, not likely - unless new fundamental/economic data comes up.

US MARKET COMMENTARY

--------------------------------------

Subprime mortgage stories continue to dominate the headlines on the U.S. front with lenders starting to tighten up their lending criteria as the number of defaults rise.

SHORT-TERM OUTLOOK

-----------------------------------

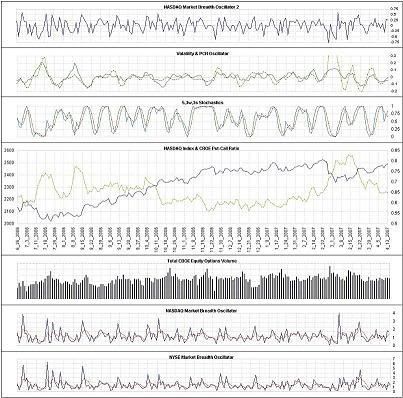

The Nasdaq Composite continued to remain bullish (i.e. made new high) but at a very controlled pace. The Volatility and PCR oscillators are in one of those rare situations where they are not ocsillating.

On the close of last friday, here's what the short-term indicators are telling us:

(1) NASDAQ Market Breath Oscillator 2 : 0.37

(2) Volatility Oscillator : -0.013

(3) Put-Call Ration Oscillator : -0.054

(4) Stochastics Oscillator : Fell to 68 and back up

(5) Put-Call Ration EMA : Falling

(6) CBOE Equity Options Volume : High

The MBO is now in high ground, with a high possibility of coming down.

The Volatility and PCR Oscillators are moving sideways.

The falling PCR suggests bullish sentiment in the market and the high volume suggests widespread interest by the participants.

So on an overall basis, there are some indication of the likelihood of future market direction in the short run. The possibility of the bull move continuing to materialise is still present. But the high reading on the MBO suggests that there might be a short (as short as 1-day) pullback early this week.

Also the increase in the buying of call options increased the likelihood of a swing coming in.

MEDIUM-TERM OUTLOOK

--------------------------------------

The Index closed up for another week, outperforming all other Asian Pacific markets as the U.S. remained relatively unaffected by the sell down that started in the Chinese market. Prices remained strong thus far.

Here's how the indicators are shaping up:

MBO: Pulled back slightly

Stochastics: Overbought, but still bullish

MACD: %k and %d crossover

The pull back on the MBO and a bullish stochastics suggest that the index is yet again likely to finish higher this coming week. The 10 and 20 period moving averages are still the indicators to watch closely because a break down through them has bearish implication(s).

The outlook remains unchanged with the possibility of trend continuation but with the likelihood of a top forming.

WHAT I'VE BEEN UP TO LATELY

----------------------------------------------------

I will be starting work this week at BNP Paribas (Sydney) on a contract basis doing fund adminstration/unit registry. Had two interviews last week, one at Morgan Stanley, and the other at BNP. The interview at BNP was much more spontaneous and relaxed than the Morgan Stanley one. A testament to the difference in the culture of these two organizations. I'm glad that Morgan Stanley said 'no' as I would've have joined if they offered simply because it was Morgan Stanley, but I believe that I would be much happier at BNP.

So that means my weekday fishing trips have temporarily come to an end.

Have a gd week!