US & Asia Pacific Equity Markets Commentary 21 - 25 Jun 07

Hi all,

Once again, the commentaries are slightly late (so what's new?). The past week saw me drilling down into the Australian market a little bit deeper. The plan is to get the data for the various sector indices as well as the sector components. That way, I can then start to do some relative strength comparison among and within the sectors. With any luck, next week will be the week that I start posting the charts of the ASX sector indices on another webpage as this blog is getting abit crowded. There are 11 sector indices and posting up the charts for all of them here is not ideal.

ASIA-PACIFIC MARKETS COMMENTARY

-------------------------------------------------------

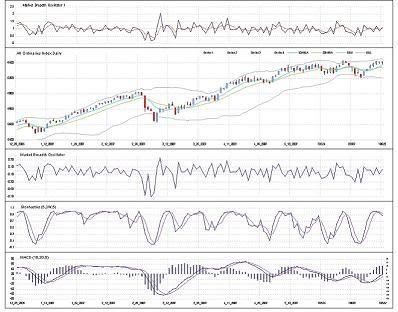

DAILY CHARTS:

The Asian markets diverged from the US Market last week due to news that the Chinese authorities has allowed financial institutions and wealth management institutions to invest "chinese money" in overseas markets.... otherwise the china stock market is gonna be greatly inflated and become more susceptible for a crash, so they thought it would be better to inflate other markets :)

So despite the drop in the US market the night before, the Asian markets actually finished higher - especially the Hang Seng Index.

And yesterday (26/06/07), the Singapore Market played catch up with the US, falling by over 50 points to bring its stochastics to oversold level. The momentum player would be looking at the Hang Seng while the swing player would be looking at the STI and the All Ordinaries.

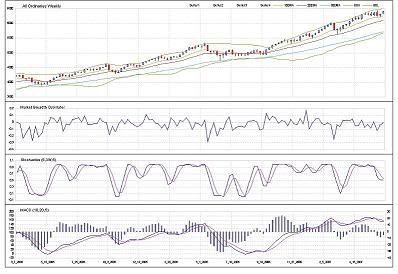

WEEKLY CHARTS:

The Market Breadth and stochastics readings remain pretty varied among the indices but their uptrends are still dominant.

US MARKET COMMENTARY

--------------------------------------

Last week was pretty 'textbook' stuff. Rising oil price causing the market to fall. It's quite strange that somehow market events happen to support technical analysis expectations... or is it merely a case of "drawing the line, then plotting the points". I learnt the phrase from a macro-econ newsletter I read some time ago. That means that our financial journalist friends are digging for stories to explain why the market has moved in a certain way (after the market has moved). Good to know, but usually too late for profit.

One more month to the July earnings season, and I should probably start finding out what sort of numbers the analysts are churning out.

SHORT-TERM OUTLOOK

-----------------------------------

The NASDAQ index turned out almost the way I'd like it to. A doji and then another small ranging day, setting up three candles forming an ideal sell trigger below once the index breaks the 3-day low. And in textbook fashion, the selldown on Wednesday (20/06) did just that. The very low readings on the Volatility and PCR oscillators provided a pretty strong indication that a pull back would happen.

This coming week, would most likely see an upswing coming in now that short-term stochastics is hitting the oversold region and the market breadth oscillator is making a higher low. The ideal situation would be a doji, hammer or small ranging day on Monday (and even better if Tuesday as well), setting up a long trigger above the 2-day high.

MEDIUM-TERM OUTLOOK

--------------------------------------

The uptrend is still intact, with the weekly market breadth oscillator at a low level, suggesting bullishness this week. How the medium term will turn out is still pretty iffy and more economic analysis is needed (havnt had the time to get around to that at the moment). Hopefully the economic data next week will provide more clues.

WHAT I'VE BEEN UP TO LATELY

----------------------------------------------------

No call from Macquarie Bank in the past week. But I'm still expecting a positive response.

Have also decided that I won't be extending my contract with BNP as a Fund Administrator as that's not what I'd like to do in the future. Sent an email to my recruitment consultant at Robert Walters and we'll see how it goes.

Have a gd week!

0 Comments:

Post a Comment

<< Home